Introduction

Ever since Gartner released its projection that the cloud management market is expected to reach $3.3 billion in 2012, it has become increasingly hard to make sense of the vendor landscape. Behind the cacophony of noise is a real and seismic change in the industry, which I call the $18 billion disruption. But making sense of this emerging industry is challenging enough for a systems management veteran, and even more so for customers just looking to solve a cloud IT challenge. To put some order to the market, I’ve created a taxonomy to help others (including me) make sense of the emerging cloud management landscape.

History

Cloud management is actually a faster growing extension of the systems management industry, which was estimated by Gartner to be $18 billion in 2012 with an 8.5% CAGR. Just as systems management is not a single product category, neither of course is cloud management. Instead cloud management is comprised of several product categories, each an emerging market segment in its own right.

By way of history, the product categories for systems management vendors of physical infrastructure resulted in numerous successful IPOs and acquisitions in the 1990s and 2000s, creating many billions of dollars in shareholder value. This market growth was then consolidated over a decade into a few companies, primarily IBM, HP, BMC, CA, Microsoft and Symantec. To give a sense of scope of the individual markets, Gartner estimated the 2012 size of availability & performance management to be $4.6B, configuration management $3.4B, application management $2B, and $1.8B for network management.

But the disruptive innovation of cloud computing has fundamentally altered the systems management landscape, spawning a new crop of cloud management vendors that are filling the wide gaps left by their systems management predecessors. We’ve watched as new names - e.g. Splunk, RightScale, Opscode - have stepped in to fill the gaps created by the inability of legacy systems management vendors to address the challenges of the cloud. With the very successful IPO of Splunk, there are early signs that history may again be repeating itself.

The Taxonomy

To put some order to the evolving product categories, I divided the industry into five product categories and four phases.

The categories reflect the problem to be addressed by a product, and include:

- Automation & deployment - Products focused on automating and deploying cloud infrastructure and applications.

- Configuration management - Products that enable the control and risk management of changes to cloud infrastructure and applications.

- Fault management - Products that provide real-time alerting and/or notification of current or potential failures in cloud infrastructure and applications.

- Cost management - Products that optimize the cost of cloud infrastructure and applications.

- Performance management - Products that optimize the performance or availability of cloud infrastructure and applications.

The four phases reflect the lifecycle in which a customers’ cloud infrastructure progresses, including:

- Plan - The planning process for deploying cloud infrastructure and applications.

- Deploy - The deployment of cloud infrastructure and applications.

- Manage - The ongoing operations and support of cloud infrastructure and applications.

- Troubleshoot - The troubleshooting of issues with currently managed cloud infrastructure and applications.

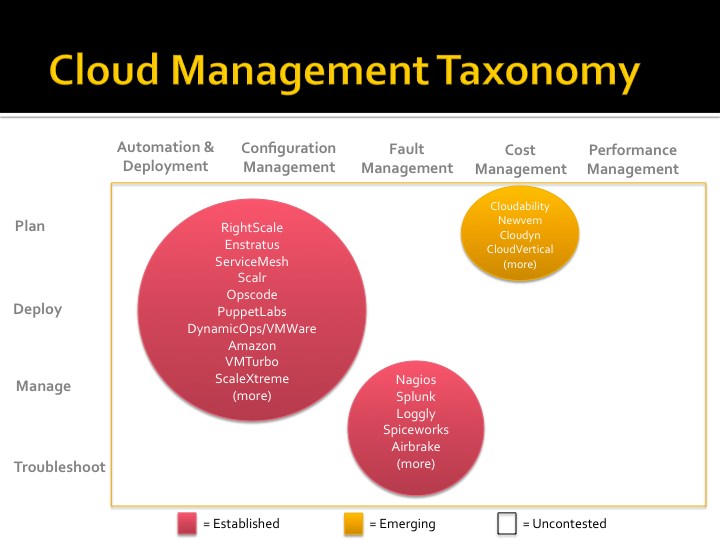

Using this taxonomy, you can draw circles around the vendors to understand their positioning in the market. To demonstrate, I’ll show a few examples.

Example Usage

I made a controversial decision in my examples: if a vendor does not support the planning, deployment, management and/or troubleshooting of public, hybrid or private cloud infrastructure, they are not a cloud management vendor. ;) Obvious, right? I only say it because some vendors are re-marketing their distinctly non-cloud products as cloud. If you can’t be one of the cool kids, I guess you can at least tell people you are a cool kid.

So with that said, below I plotted a few vendors on the chart to demonstrate the evolving product categories.

Deployment Management

The left circle shows what is by far the most crowded and hotly contested area of cloud management: the automation, deployment and configuration management of cloud infrastructure and applications. The products include both open source and commercial solutions, and span vendors such as RightScale, Enstratus, ServiceMesh and DynamicOps (VMWare). I personally know of 30+ vendors in this segment, with no clear market leader, and a lot of DIY. In addition, cloud vendors are increasingly seeing this category as an extension of their cloud services (e.g. Amazon Cloudformation and ElasticBeanstalk).

Fault Management

The next circle shows the emerging fault management category, which is a semi-crowded market that has also seen some early IPOs / acquisitions (e.g. CloudKick). To further confuse matters, some of the vendors in the Deployment category offer basic fault management features (note: which often are insufficient for most customer use cases). No product here has strong brand recognition, and there is also an ongoing love-hate relationship here with the open source product Nagios.

Cost Management

I’m conflicted as to whether cost management is an emerging product category or is a feature of another product category. This category has several active players (e.g. Cloudability, Cloudyn, Newvem, CloudVertical), primarily focused on helping you understand your Amazon bill. Since this category did not have a corollary from the systems management industry, it will need time to mature in order to accurately predict its future - but there is at least enough vendor activity to warrant its mention.

Conclusions

I strongly believe we are watching the disruption of an $18 billion industry, as existing market leaders in systems management struggle and fail to break free of the value chains that anchor them to increasingly outdated and ineffective value propisitions. If this proves true, we should be seeing soon additional IPOs and acquisitions, as existing categories mature and new ones are created.

I’m happy to iterate the taxonomy in future posts based on reader feedback. I know I should have added a Security Management column - but I couldn't find enough vendors in that segment yet to warrant adding to the chart yet.

Related Posts: The $18 Billion Disruption