I recently came across my original pitch deck for CloudHealth Technologies. It was like finding a time capsule in the ground, perfectly preserving a moment from when CloudHealth was a one-person business fueled by nothing more than hopes and dreams. The deck was created for a meeting that brought together my board of advisors to discuss where I should go next with the business. E.g. Do I continue to bootstrap or raise venture capital? Do I go find a CEO or am I the right person for this job?

Almost nine years have elapsed since I made this deck. During that time CloudHealth would go on to become a successful business, supporting 5K+ customers in growing and scaling in the public cloud, and employing over 200 people globally before its acquisition by VMware in 2018. But when this deck was created, all I had was a crude Minimum Viable Product, one committed but not yet paying customer, and the hope that I could figure out a way to build a successful business.

So let’s do the post-mortem on this original pitch deck.

What I Got Right

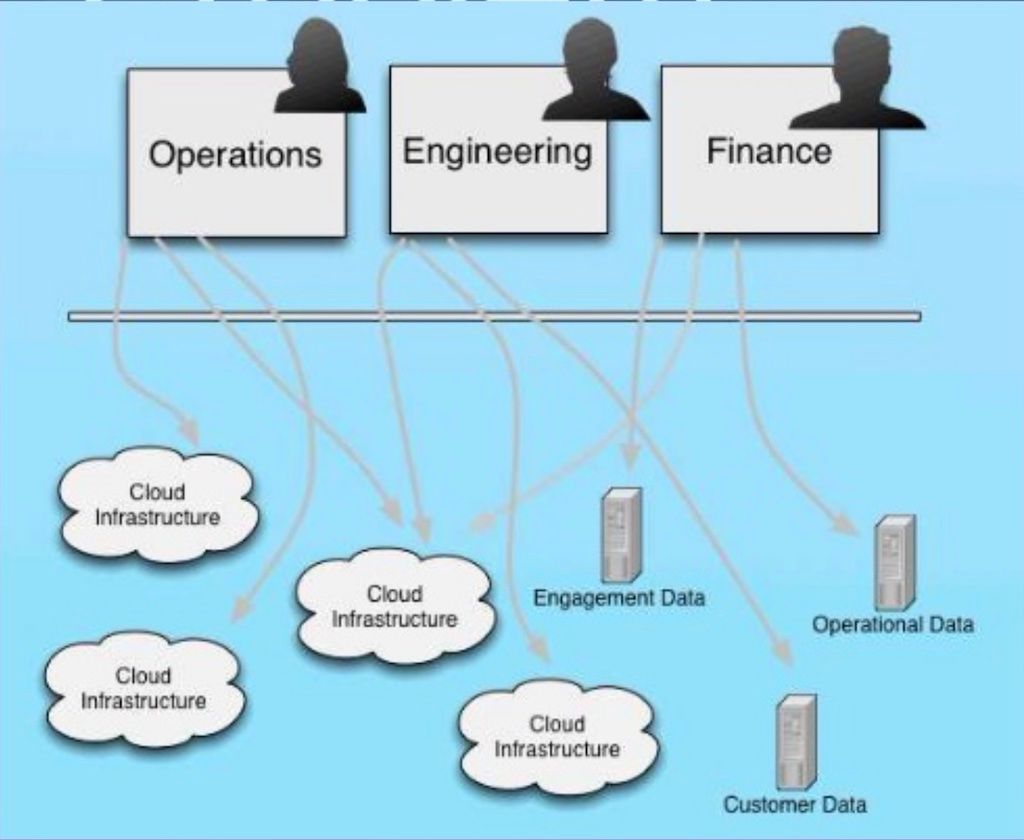

- The problem statement (slide 4) still rings true today: organizations are struggling with managing the cloud at scale, and using manual labor / custom tools to fill the gaps. That said, no one would ever accuse me of making polished marketing slides. I particularly like my attempt to show complexity with arrows going in all directions.

- The value proposition (slide 5) also rings true today. You can see all the elements for what became CloudHealth: costs, visibility, policy-driven management, business-context, open APIs, and integration into existing systems.

- The initial target market (slide 7) is surprisingly on-target. The Lean experiments I had run over the previous months enabled me to realize that while the addressable market was anyone using the public cloud, I needed to focus on an early mover subset of this market to establish my beachhead. Mid-market SaaS was exactly the right choice, since they were adopting and growing in the cloud much faster than any other cohort. This is a great example of small decisions that can have an amplified impact on the trajectory of a business.

- The business model (slide 8) was pretty spot on. The previous months I had been trying to figure out a pricing model that would scale with the complexity of a customer’s infrastructure. I had the Einstein quote about compound interest in my head, and wanted to find a way to tie my pricing to the Compound Annual Growth Rate (CAGR) of the public cloud. The result: a pricing model based on percentage of spend. You can also see all the other elements of our business model here too: SaaS, inside sales, digital marketing, free trials, multiple clouds.

What I Got Mostly Wrong

- The competition slides (slide 10-11) are mostly wrong. Many of the players here - i.e. Datadog, RightScale, enStratus, Newvem - never actually became competitors. Others - i.e. Cloudability, Cloudyn - only became competitors after a couple years due to the green field nature of an emerging market. Every investor wants to see a competitive slide, but the reality is that when you create a new product category, you really only have two competitors: (1) do it yourself, and (2) do nothing.

What I Got Wrong

- The market definition (slide 6) is profoundly wrong. I remember wanting to show a $1B Total Addressable Market (TAM) within 4-5 years. My goal was to stay in the “Goldilocks zone”, with a market that was not too small (which investors would view as not capable of supporting a large business), and also not too large (which investors would assume would be owned by big established players). So I found a way to do this: by 2016 a $24B cloud market, producing a $3.4B cloud management market, and providing my business a TAM of $990M. What were the real numbers? Probably closer to $20B, $700M, $150M. So yeah, I was really wrong. Also, did I really call the new market I was creating... CACM? 😉

- The product architecture (slide 9) is one of those throw-aways you include in a deck to ensure investors can confidently conclude: (1) this is a hard problem, and (2) the entrepreneur knows what they are doing. Judged on this level, I can say I got this right. But there are many elements here that I assumed would be in the original 1.0 product that took years to evolve - e.g. policy management core, user extensible data correlation, customer-driven data, application profiling, collaboration & community. Sometimes your vision is unfortunately too far ahead of your execution.

- The financials (slide 12) are wrong on many levels. I had tried out a fractional CFO to help me produce the financial plan, with the idea I might hire him part-time to support me in the first year of the business. It’s clear in reviewing this now that I failed to make him understand the business. First, this is a P&L for a licensed software not a SaaS business. Second, I chose to include OEM revenue that never became a core part of the business. Third, the bottom up business assumptions behind the financials were entirely wrong. That said, we substantially beat those revenue numbers, so maybe sometimes three wrongs really can make a right.

- The company name in this pitch deck was CloudPercept, a name I adopted early in the business. When I brought Dan Phillips on board as CEO, he had a viscerally negative reaction to the name CloudPercept. On the way to our closing dinner for our first round of venture capital, he proposed the name CloudHealth. After a short detour to a coffee shop to buy the domain, transfer the DNS, and update the web site, we never looked back.

Conclusions

I am going to give myself and the advisors who supported me a solid B+ for this pitch deck. I got more right than wrong here, in a large part because: (1) I was a customer of my own product before I built it, (2) I had deep expertise in the public cloud & infrastructure management markets, and (3) I spent the previous months running Lean experiments that really helped me validate the critical assumptions for the business.

But I also benefited from taking a market-driven approach instead of a product-driven one. I started the business with a high-level market to explore: the intersection of public cloud & infrastructure management. I then experimented my way to a specific target market: cloud cost & usage management. I've seen too many businesses start with a specific product idea and then try to retrofit a viable business model. My CloudHealth experience proved to me that it is a lot easier to "telescope" your way down to a successful business than it is to pivot. As much as we live in the era of pivot and fail-fast, there is nothing easy about a pivot. A little upfront top down research / experimentation can save a lot of time, money and angst performing pivots later in your business.