In continuing down my punch list of technologies I have neglected for too long, I spent the last few days doing a deep dive into DeFi. This of course builds on my previous work in blockchain, cryptocurrencies and NFTs. I researched decentralized exchanges, stablecoins, borrowing, lending, staking, Automated Market Movers (AMMs), synthetic assets, derivatives, insurance, margin trading, tokensets, liquidity pools, oracles, physical assets on chain, and more. Where possible I tried to use services, making small trades to get a better feel for how they worked. The entire experience had the feeling of walking into the Leaky Cauldron, tapping my magic wand on a brick wall, and entering Diagon Alley for the first time. As usual, here are my thoughts.

What Is DeFi?

For those of you who are new to Decentralized Finance, let’s start with a definition. DeFi is a movement that seeks to replace the existing financial system with one that is decentralized, anonymous, not reliant on trust, and accessible to all. The movement evolved out of the Great Recession, where the unfairness of the current central bank system was laid bare by governments bailing out too-big-to-fail financial firms that profited off the very risks they took to create a global recession. DeFi seeks to democratize finance, eliminating reliance on traditional banks and financial firms, and doing so with anonymity and freedom from governmental oversight.

By building on the foundations of the cryptocurrency market - e.g. blockchain, tokens, consensus networks, smart contracts, Decentralized Autonomous Organizations (DAOs) - the innovators of DeFi have created all the core constructs of a financial system on top of cryptocurrency. These include stable currencies, exchanges, lending, borrowing, derivatives, and margin trading. They have also created many financial instruments that do not exist in the current financial system - e.g. synthetic assets, staking, physical assets on chain, and more. The DeFi market has advanced quickly, with most of the innovation occurring in projects instead of companies. It is not uncommon for the leaders of these projects to seek to remain anonymous to maximize their freedom from oversight (even raising venture capital in some cases without investors knowing who they are).

Examples

At this point if you are still wondering what DeFi actually is, you have my full sympathy. Here are a few examples of real world use cases today, hopefully a few of which will actually make sense to you:

- Earn interest on cryptocurrency while supporting an underlying network (staking).

- Earn interest on cryptocurrency while still retaining liquidity on the underlying asset (liquid staking).

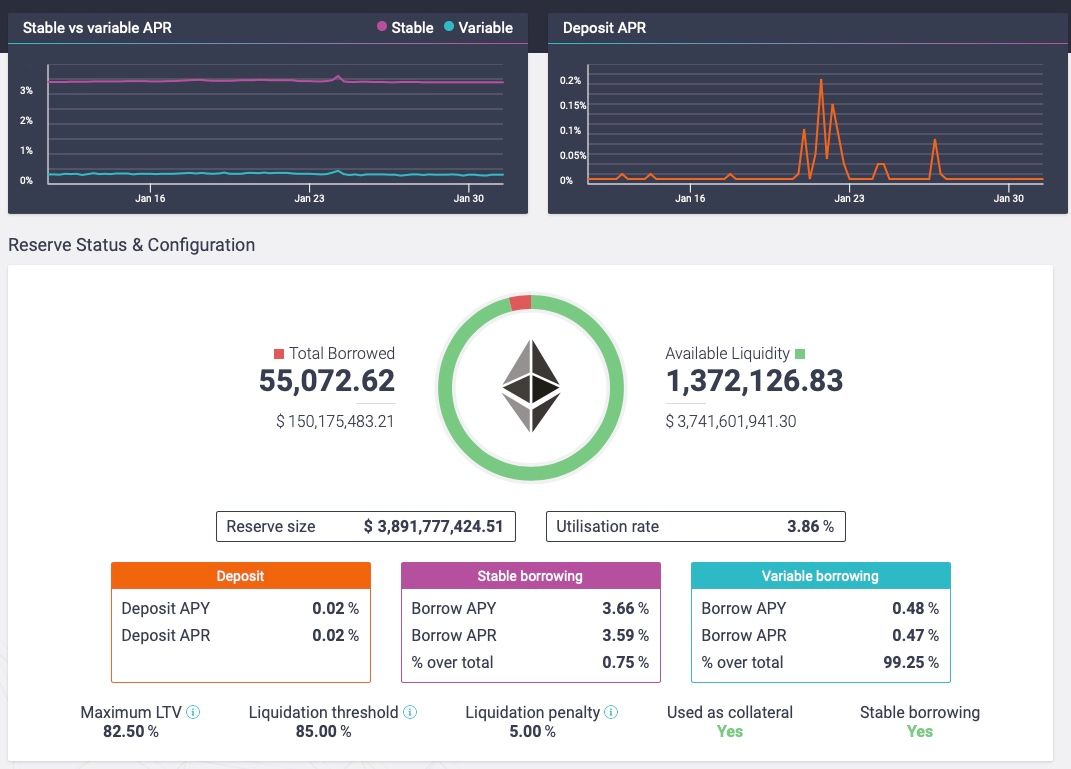

- Take a loan out using cryptocurrency as collateral (borrowing).

- Lend cryptocurrency to others in return for earning interest (lending, liquidity pools).

- Swap cryptocurrency without paying high fees of centralized exchanges like CoinBase (decentralized exchanges).

- Automate crypto portfolio management by mirroring the strategies of top asset managers (tokensets).

- Bet on the future of a stock - e.g. Microsoft - without having to own the actual asset (synthetic assets).

- Gain short term access to capital by selling fractional ownership of a real world invoice (physical assets on chain).

Introducing the Technology Adoption Life Cycle (TALC)

I’ll be referencing the Technology Adoption Life Cycle in my post, which was popularized by Geoffrey Moore’s Crossing the Chasm in the 1990s. For those of you who are not familiar with it, here is a quick refresher:

In the Technology Adoption Life Cycle, the first movers in technology markets are called innovators: enthusiasts driven by a passion for the technology and the community that forms around it. As a market matures, the innovators are followed by early adopters, who are visionaries that are willing to invest in a technology early because they see its long term potential. They are followed by the early majority: pragmatists whose interests are often driven by more practical applications of the technology in their lives and/or businesses. Next come the late majority users, who usually adopt a technology unwillingly, and even then only on the best possible terms - e.g. price, ease of use, integration. And finally, in the latest stages of a market, we have the laggards: the skeptics who usually have the technology forced on them by a market that has already passed them by.

In Geoffrey Moore’s telling of the Technology Adoption Life Cycle, there exists a chasm between the early adopter and early majority that causes many technologies to falter before they achieve mainstream adoption. This chasm is often driven by the radical differences between the visionary early adopters and the pragmatist early majority.

If I were to plot DeFi on the TALC, I would place it mid-way through the early adopter phase. We will discuss this in more detail below. Now let’s move on to the four thoughts that emerged from my deep dive.

#1: The Real Market Potential Is Obscured By Excess

Last year alone, venture investors poured $33B into the crypto market. This investment has been amplified by a white hot speculator market that has driven a steady stream of new investors looking to become the next crypto millionaire. The result is a total crypto market capitalization of $1.6T - or roughly 7% of the US economy in 2021. If crypto were a financial institution, it would rank as the 4th or 5th largest in the world - right up there with the too-big-to-fail firms that brought us the 2008 crash. For the first time in modern history, a loosely organized project backed by a few engineers can have more funds under management than a mid-sized 20+ year old hedge fund. I find this simultaneously both impressive and terrifying.

The good news is many of the innovations in DeFi appear to be long lasting - e.g. smart contracts, DAOs, AMMs, peer to peer lending, stablecoins, decentralized markets, tokensets, and more. So are many of the values DeFi is bringing to us - e.g. transparency, accessibility, ease of use, and a level playing field. While the excessive exuberance, rampant speculation and overinvestment is making it hard to see the real potential of the DeFi market, if you can look past this, I believe you can catch a glimpse into the future of our all digital financial system.

#2: Government Regulation Can & Should Be Coming

When DraftKings launched in Boston, it started a multi-year battle over the legality of online sports betting. The fight occurred at a state and federal level, and eventually arrived at the US Supreme Court. Today sports betting is legal, regulated, and commonplace. Now imagine instead of a single company like DraftKings challenging existing laws and regulation, we had 1000+ companies doing so all at once. Or to be more precise - 1000+ projects - since in many cases the DeFi services have no corporate entity and often operate outside of US jurisdiction. Welcome to DeFi.

The innovation in this market is undeniable. And so is the fraud. What I think is making it mostly work is that the early adopters are, as a general rule, the crypto equivalent of accredited investors. Yes some of them have been the victims of smart contract defects, rug pulls, key phishing scams, and other forms of cybercrime. But they are also skilled at reading white papers, following Discord channels, researching project team members, reviewing smart contracts, and performing other forms of due diligence before making their investments. This level of both technical and investment knowledge is highly unlikely to be transferred to the early majority users, and thus some level of government regulation will be required to ensure the long term operation of a fair and efficient DeFi market. Its also likely some level of regulation will be required for crossing the chasm.

#3: The Chasm Looks Really Wide

DeFi shows all the signs of a market that has advanced beyond the innovator phase and is well into the early adopter. These early adopting users have a deep passion for the technology & community, place a high value on anonymity, and are committed to being free from centralized control (e.g. banks, governments). The day traders in this market are willing to invest in intricate high risk strategies to make money - e.g. liquid staking their SOL on Marinade.finance in return for mSOL, then bringing the mSOL to Compound.finance to use as “money legos” to borrow stablecoin to purchase more SOL, which they then liquid staked, only to rinse and repeat it all again. In some ways, these early enthusiasts are the closest the technology market has to doomsday preppers: believing in a near post-apocalyptic world in which centralized governments and organizations no longer exist.

But I can say with absolute confidence these innovators and early adopters will not be the early majority users when DeFi goes mainstream. The early majority user is less likely to be absolute in their beliefs. For example, they may want reduced friction in the financial system and more accessibility, but may not be as committed to decentralization. They may be more interested in less risk and lower volatility than they are in engaging in the technology and community. And they may be willing to give up anonymity and freedom from oversight for access to financial opportunities previously unavailable to them. In other words, instead of being anonymous crypto hackers & day traders, they are more likely to spend about as much time on DeFi as they might today on managing their personal finances. If true, this could portend some dramatic market changes and opportunities in DeFi.

#4: Full Decentralization May Not Be the Future

Two of the core values of DeFi are anonymity and decentralization. For example, let’s say you are participating in a sports betting DAO in which you place money on tonight’s Celtics game. The payout of course will depend entirely on whether the Celtics won. In the real world, there are many ways we can know the results of a basketball game - e.g. watch it live, check the news, go to nba.com, search for the results on Google, and so on. But since the bet in DeFi will be settled via a smart contract, any tampering with the source of truth could result in you being scammed. So what is the DeFi community solution for this? Oracles: networks that deliver real-world data to smart contracts by putting it on the blockchain. The solutions vary slightly, but the general approach involves incentivizing a network of anonymous nodes to propose data to be stored on-chain, each potentially using different data sources. Instead of relying on a single source, the correct answer is determined by consensus by aggregating the results of many nodes (e.g. Byzantine general problem)

It’s an impressive set of innovations that provides a solution to a problem many of us never knew we had: knowing who won the Celtics game last night. It also shows how far the innovators in this market are going to ensure the system can be operated without any centrality. Is this the future on which we want to base our financial system and next-generation of the World Wide Web? Maybe. But it's more likely this commitment to decentralized purity will not cross the chasm intact.

Last Thoughts

After coming back from my trip down DeFi Diagon Alley, I am walking away deeply impressed with the innovation happening in this market. But at the same time, I worry the value of this innovation is being artificially inflated by extreme overinvestment, hype and fraud - much of which will have to get propped up for years to justify investments. I also worry that the great chasm between early adopter and early majority users means the DeFi market is going to have to undergo a dramatic transformation to go mainstream - all while trying to live up to the inflated expectations of investors. But at the same time, I remain bullish, because from my personal experience in other disruptive markets, I know one secret: the biggest and most impactful long term opportunities are almost always found in crossing the chasm.